Introduction

Navigating the intricacies of Corporate Income Tax Filing in Canada can be a daunting task for businesses, especially given the complexity of tax regulations and the need to stay compliant with federal and provincial laws. Understanding the essentials of this process is crucial for companies aiming to optimize their tax outcomes while avoiding potential penalties.

Understanding Corporate Income Tax Filing

Corporate Income Tax Filing in Canada involves reporting the financial activities of a corporation to the Canada Revenue Agency (CRA). Every corporation operating in Canada is required to file a T2 Corporation Income Tax Return annually, regardless of whether it has taxable income or not. This ensures that the CRA has a complete picture of the company’s financial status and can assess any taxes owed.

Key Tips for Efficient Filing

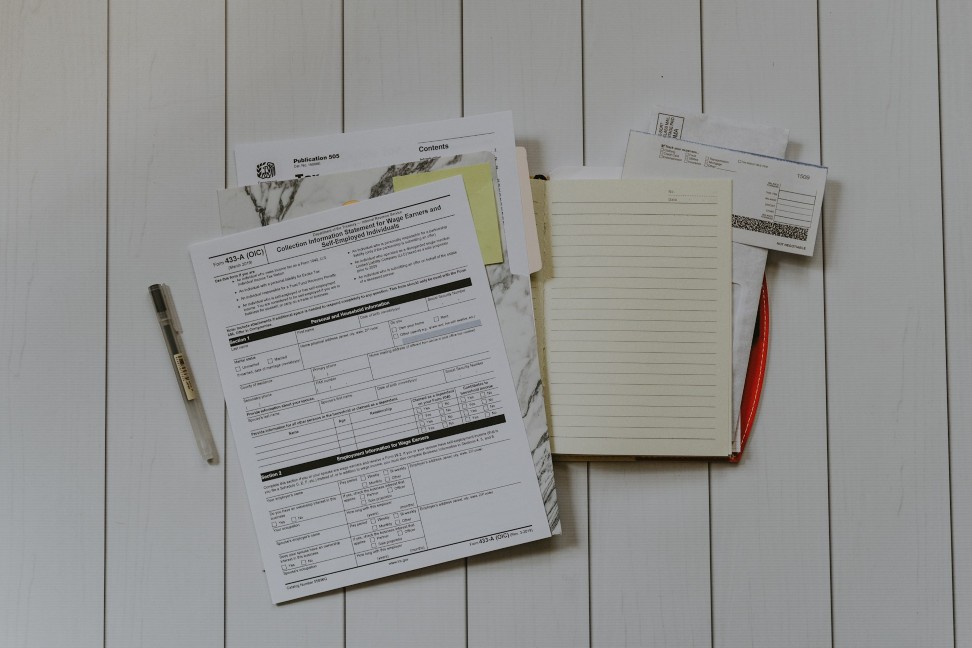

1. Maintain Accurate Records: One of the most critical steps in Corporate Income Tax Filing is keeping meticulous records of all financial transactions. This includes maintaining documents such as receipts, invoices, and financial statements. Accurate records not only facilitate the filing process but also provide evidence in case of audits.

2. Understand Deductions and Credits: Familiarizing yourself with the various deductions and tax credits available can significantly reduce your taxable income. For example, deductions for business expenses, capital cost allowances, and research and development credits can provide substantial tax relief.

3. Use Professional Services: Given the complexities involved in Corporate Income Tax Filing, many corporations opt to engage professional accountants or tax consultants. These experts are well-versed in the latest tax laws and can help ensure that all filings are accurate and submitted on time, minimizing the risk of errors and penalties.

4. Keep Track of Deadlines: Missing the filing deadline can result in penalties and interest charges. Generally, the deadline for filing a T2 return is six months after the end of a corporation’s fiscal year. It is essential to mark this date on your calendar and ensure all necessary documents are prepared well in advance.

Conclusion

Mastering Corporate Income Tax Filing in Canada requires a thorough understanding of tax obligations, diligent record-keeping, and strategic planning. By staying informed about the latest tax laws, utilizing available deductions and credits, and possibly engaging professional help, corporations can effectively manage their tax responsibilities. This not only helps in maintaining compliance but also optimizes tax outcomes, allowing businesses to focus on growth and development.

************

Want to get more details?

Cloud Accounting & Tax Services Inc. | CLaTAX

https://www.claccounting-tax.ca/

+1 (855) 915-2931,

Glenlyon Corporate Centre, 4300 N Fraser Wy #163, Burnaby, BC V5J 5J8

Brand Profile: Cloud Accounting & Tax Services Inc. | CLaTAX

Mission Statement

We aim to protect our clients’ financial interests with integrity, providing essential services for a secure financial future. We treat our employees and clients with respect and professionalism.

Vision

To be Canada’s leading provider of innovative accounting and tax solutions, leveraging technology for accessible, high-quality financial services.

Values

Integrity: Ethical and transparent operations.

Excellence: Constantly improving to meet clients’ needs.

Client-Centric: Tailored services for unique goals.

Innovation: Utilizing the latest technology.

Respect: Professional treatment for all.

Services

For Individuals and Families

Personal Income Tax Preparation

Penalty and Interest Relief Requests

Income Tax Reviews

Pension Assistance

Financial Management Solutions

For Business Owners

Bookkeeping Services

Tax Planning and Consultancy

Payroll Solutions

Penalty and Interest Relief

Financial Management Solutions

For Corporations